Technology is changing everything, be it the tasks we perform in our everyday life or the way the entire world works. Even in the financial world, this change is very much evident.

The innovations brought by fintech have changed the way money used to be managed or received. And among the various ways in which fintech is helping traditional banks and other financial institutions adapt to the digital age mobile payment is certainly one of the most significant ones.

With 89% of respondents to a survey by Business Insider already using mobile banking along with 97% of the millennials, we think it’s high time that you become aware of Fintech, especially mobile payments, its challenges, and future possibilities.

So, just put your curious glasses on, and let’s explore mobile payment in a fintech environment.

Have you ever checked your finances online? Have you enjoyed the convenience of automated invoicing? Then you have already used “Fintech” or Financial technology.

Fintech refers to the different types of modern innovations to the finance system. Any program that uses a mobile device or the cloud, and an internet connection to provide financial services is a fintech program.

The fintech market globally is expected to reach $310 before 2022 ends.

From authenticating electronic payments to buying or selling cryptocurrencies, or scheduling a vendor payment at the bank to any financial service using advanced technologies is known as Fintech to businesses or consumers.

Mobile payment has a special place in the fintech environment. With this technology, it’s believed that the underbanked population can finally be reached out to. And this fintech technology trend can even finally put an end to the use of traditional wallets.

The very purpose of this technology is to create new opportunities for businesses as well as individuals to manage their money more efficiently and effectively. Thanks to the mobile payment technology in the fintech space, many of the most cumbersome and complex financial processes have become more accurate, simple, and of course efficient.

Although many people are still used to their traditional wallets; but the speed at which major players in the industry like Google, Apple, and Samsung have already introduced their own versions, it’s only a matter of time that the majority of the global population will embrace mobile payment.

Unlike traditional banks that are more concerned about their shareholders’ interest; fintech focuses on the requirements and needs of its end-users.

Yes, fintech is in a way raising the expectations or standards for the traditional banks; but it’s also letting the banks leverage from fintech itself by allowing them to embrace the technology. Take the example of the mobile apps launched by the banks for helping users conduct various payment processes without any hassle through their smartphones.

Some of the major perks of mobile fintech payments are:

Fintech industry trends like mobile payment technology let banks and other financial institutions improve their services by providing the customers with innovative services and products.

Some of the major financial service sectors where fintech has made remarkable inroads are payments, insurance, investments, real estate, and, very recently, payment processing to online retailers, personal finance services, loan refinancing, cryptocurrency exchange services, etc.

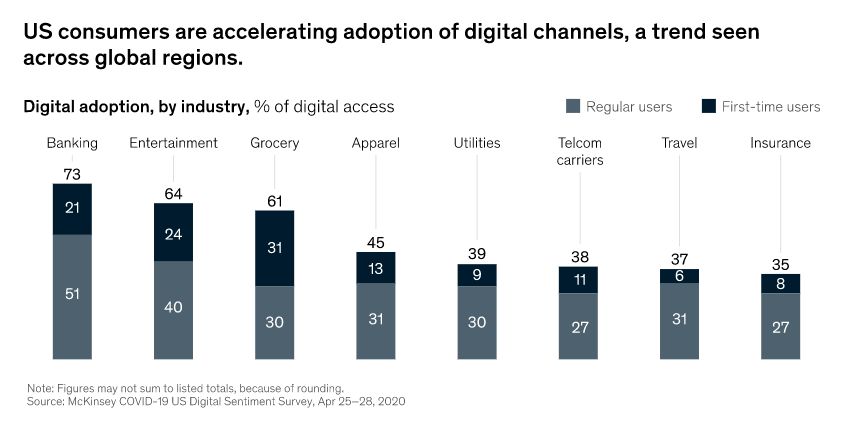

The outbreak of the Covid pandemic last year has made more people in the US shift towards mobile payment. Yes, as per the latest data, in the adaptation of advanced digital technologies in the financial secret, business and consumers have advanced almost 5 years within only 8 weeks.

Taking care of major banking processes, fintech is here to turn your business processes more efficient, secure, and streamlined.

There are various categories of mobile payments. Some of which are mobile payment platforms, direct carrier billing, independent mobile payment, etc. Though these various categories of mobile payments have become popular among businesses and individuals, due to the convenience they offer; there are certain challenges, especially security threats, as well.

According to a survey, in 2019 alone, the total percentage of crimes related to mobile payments reached 71%.

So, here, we have summarized the major challenges faced by mobile payment in the fintech space. Let’s take a look at them.

Mobile malware is one of the major threats that target the mobile payment system. Most of the mobile malware is related to different activities like instant messages, recording calls, forwarding call logs, locating vis GPS, etc.

Malware usually monitors and records all incoming messages from the bank or steals the one-time password sent by the bank to authenticate a transaction and then forward them to a malicious website. Some malware can even intercept the banking credentials of a user and drain their account.

And the worst part is that, despite taking numerous measures to detect and prevent malware attacks, malware eventually finds a way to propagate mobile payment systems, making mobile malware detection a pretty challenging task.

Various mobile payment systems depend on TLS(Transport Layer Security) and SSL (Secure Socket Layers) to keep the users’ data protected on the internet. However, the implementation of these safety protocols may have certain vulnerabilities that malicious users can leverage to breach the security of the payment system.

And not only these, TLS and SSL are also vulnerable to the attacks of MITM or the man-in-the-middle. In MITM, the attacker usually intercepts the communication between a user and the payment application either by impersonating one of the two parties involved in the transaction or by eavesdropping.

When it comes to mobile payments, the problem of data breaches is getting pretty common these days. And when that happens, sensitive information of a user such as his mobile phone number, his purchase records or transaction history, his credit card details, etc. get compromised.

Usually, when a user makes a purchase at a mobile wallet as the point of sale or POS through a mobile wallet, there are five players involved who need access to the transaction data for the successful completion of the purchase. These five players are the mobile wallet service provider, the merchant, the POS service provider, the issuing bank, and the acquiring bank.

Though there are regulations to be maintained and followed by all the parties to ensure a secure payment; there are rooms for data leakage or data breach to occur. Putting user privacy at risk, a data breach during mobile payments can even lead to identity theft.

When a user signs in to a payment service from a new mobile device, multi-factor authentication is applied by many as one of the preferred ways of preventing fraud over mobile payment systems. In this type of security measure, a user is required to enter a secret authentication code that is sent to him by the mobile payment system through communication channels like his mobile number or in his email.

However, one never knows when he might end up losing his phone or misplacing it. Mobile phones can also get stolen easily. And this “Oh shit! I lost my phone” thing means malicious users can get access to your mobile as well as your email account and messages and quickly spoof the multi-factor authentication in seconds.

One of the major reasons for the popularity of mobile payments in fintech is that payments can be done from anywhere at any time. And this ability to avail payment services from anywhere and everywhere often puts mobile payment services at risk of fraudulent activities.

How?

Well, compromised mobile payment accounts or stolen credit cards may lead to the stealing of money and fraudulent transactions.

The benefits offered by mobile payment are plenty and strong enough to outweigh the challenges that its technological innovations face. Given its tremendous perks, mobile payment is often seen as a disruptor to traditional banking. It can’t be denied that by joining this technology, banks can better serve their customers as well as businesses. With the help of mobile payment, even non-bank service providers can add value to the banking processes.

These days, more and more mobile payment platforms are coming up (read Venmo, Google Pay, PayPal, Zelle, Circle Pay, Square Cash) that not only feature fingerprint readers but also support the future growth of mobile payments. Also, these offer a better and more personalized experience to the users. Dealings using chaotic cash are being replaced with easy, quick, and secure mobile payments.

With people becoming more and more attached to their smartphones, mobile payment is believed to end the cash era in the future.

Mobile payments come with multiple layers of security barriers. And it also serves as proof of a financial transaction. Though cash is already being considered as a less secure and inefficient mode of payment, the fintech world is yet to reveal the true potential of mobile payments in the future.

Technology is no longer just a “nice-to-have” idea but a “must-have” part of our life. Technology lies at the core of almost everything we do today. Then why should the financial processes be ignorant of it!

At Klizo Solutions, we help you integrate and implement the latest and best technologies to better manage your business processes and maximize the ROI while ensuring maximum online safety.

Trusting our team of expert and skilled developers lets you build custom fintech products and apps from scratch that succeed in overcoming the common challenges of mobile payments.

Want to learn more about us or what we can do for you and your business? Then click here and get in touch with us today!

Previous article

Joey Ricard

Klizo Solutions was founded by Joseph Ricard, a serial entrepreneur from America who has spent over ten years working in India, developing innovative tech solutions, building good teams, and admirable processes. And today, he has a team of over 50 super-talented people with him and various high-level technologies developed in multiple frameworks to his credit.

Subscribe to our newsletter to get the latest tech updates.